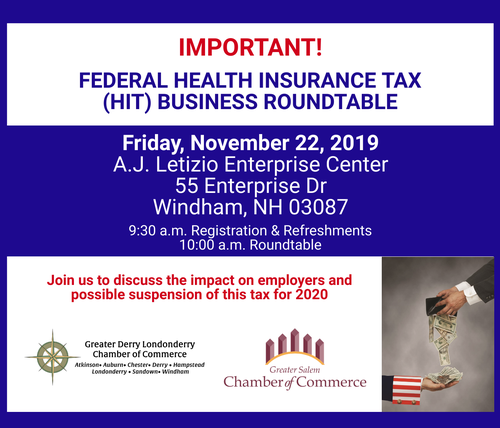

Advocacy Seminar: Health Insurance Tax (HIT) Business Roundtable

Date and Time

Friday Nov 22, 2019

9:30 AM - 11:00 AM EST

Friday, November 22, 2019

9:30 a.m. Registration & Refreshments

10 a.m. Program

Location

A.J. Letizio Enterprise Center

55 Enterprise Dr

Windham, NH 03087

Fees/Admission

FREE to Attend

Please R.S.V.P.

Description

The Greater Derry Londonderry and Greater Salem Chambers of Commerce are co-hosting attend a very important Roundtable regarding the federal Health Insurance Tax (HIT) slated to go into effect in 2020.

The HIT is a federal sales tax on health insurance plans purchased by small business owners and workers who receive their health benefits through an employer.

U.S. Senator Jeanne Shaheen of New Hampshire introduced the ?Healthcare Insurance Tax Relief Act,? a bi-partisan bill in the U.S. Senate that would delay implementation of the HIT tax for 2020 and 2021. Congress needs to act immediately to delay the Health Insurance Tax from going into effect in 2020. If Congress does not suspend this tax in 2020, New Hampshire small business owners, non-profits, and seniors on Medicare will be hit with higher health insurance premiums as they renew their coverage next year.

Businesses and non-profits throughout our state have been expressing their concerns regarding how the health insurance tax would cost them roughly $500 for each employee they offer coverage. This tax will negatively impact small businesses and no-profits with a significant increase in their health care costs each year, with absolutely no impact on the quality of their health care or the depth of their benefits.

It is important that we share the potential impact of this HIT on our businesses with Congress. Representatives from each of the offices of our Federal Delegation have been extended invitations, so this is an opportunity to meet and share our stories directly with those key individuals.